Over the years I have had many people asked me to write a blog post about finances. What tips did I have for saving? How do I find myself being able to afford my lifestyle and life in NYC in general? Did I have tips to manage your money when it came to self employment? I think money management can be a really overwhelming topic and things like saving for retirement seem scary and foreign and hard, frankly.

Best Money Management Tips

The truth is, I’ve learned so much about how to be better about finances in my late 20s and early 30s. And there are several things I wish I had done sooner when it came to saving more and better managing how I was spending. And of course I have financial decisions I regret. But we’re all human and the best thing we can do for ourselves is try and set our future selves up for success.

I hope you’ll have a few takeaways from today’s post that you can begin to employ in your own life!

Track your expenditures carefully.

When I was trying to determine whether being self-employed was financially viable, one of the first things I did was build an excel grid of my regular expenses. Rent, utilities, cell phone bill, average grocery bill, meals and drinks out, etc. I wanted a snapshot of what life in NYC was really costing me every month. It was an eye-opening experience and ultimately led me to building an informative budget. Which leads me to my next point…

Actually set a budget.

I have a Mint account where I set budgets for my most common monthly expenses. I love that Mint alerts you when you’ve gone over your budget so you know that perhaps you shouldn’t have plans to eat out three more times that month since you’re already over budget. It also helps give you a snapshot of how much money you’re spending every month overall. It showcases where you may want to cut back and tracks your net worth and any debt.

Another thing I love about Mint? It serves you your most up to date credit score regularly. Paying attention to your credit report is hugely important and can help incentivize smarter spending. Particularly, if you plan to rent or buy a home or car in the future. And FYI: Mint has an incredibly informative blog that shares loads of good articles on money management and personal finance tips.

Pay off the bills that you lose sleep over first.

Student loans causing you sleepless nights or ongoing stress? Create a plan that’ll help you chip away at them so you know you’re making progress. Get a bonus or come into a bit of extra cash?

Don’t hesitate and put it straight towards any debt you’ve incurred. And pay off your credit cards every month! Don’t allow those balances to add up. Paying off debt is one of the best things you can do for your mental health and for your overall wealth.

Definitely have that in-case-of-emergency fund.

During my second year in New York a crooked landlord bought the building I was living in and began trying to get tenants out so they could renovate units and double the prices of the rent they were charging. I will spare you the long and extremely stressful story (that I’m not sure I’ve ever emotionally recovered from) but I ended up being told the building was no longer structurally sound and I needed to move out. Eventually lawyers were involved and I had to live out of a suitcase and on friends’ couches for more than three weeks. Stressed was an understatement. But the process ended up with me having to essentially clean out my savings account at the time to get the money together to move into a new place.

Having the money I needed when I needed it was the biggest eye opening moment because I kept thinking “what would I have done if I didn’t have these couple of thousands of dollars in savings” for me to use? You absolutely need to have a savings buffer where you can go if you ever have an emergency. If you don’t have one yet start it today with whatever amount you feel comfortable using but just start. And then keep prioritizing it. Decide to stay in one night? Take the $100 you may have spent on drinks/dinner/cabs and put it in that fund. Keep building it up as much as you can. Sadly this is often more of a when not if type of savings because let’s be real, $h!t happens.

Go after free money.

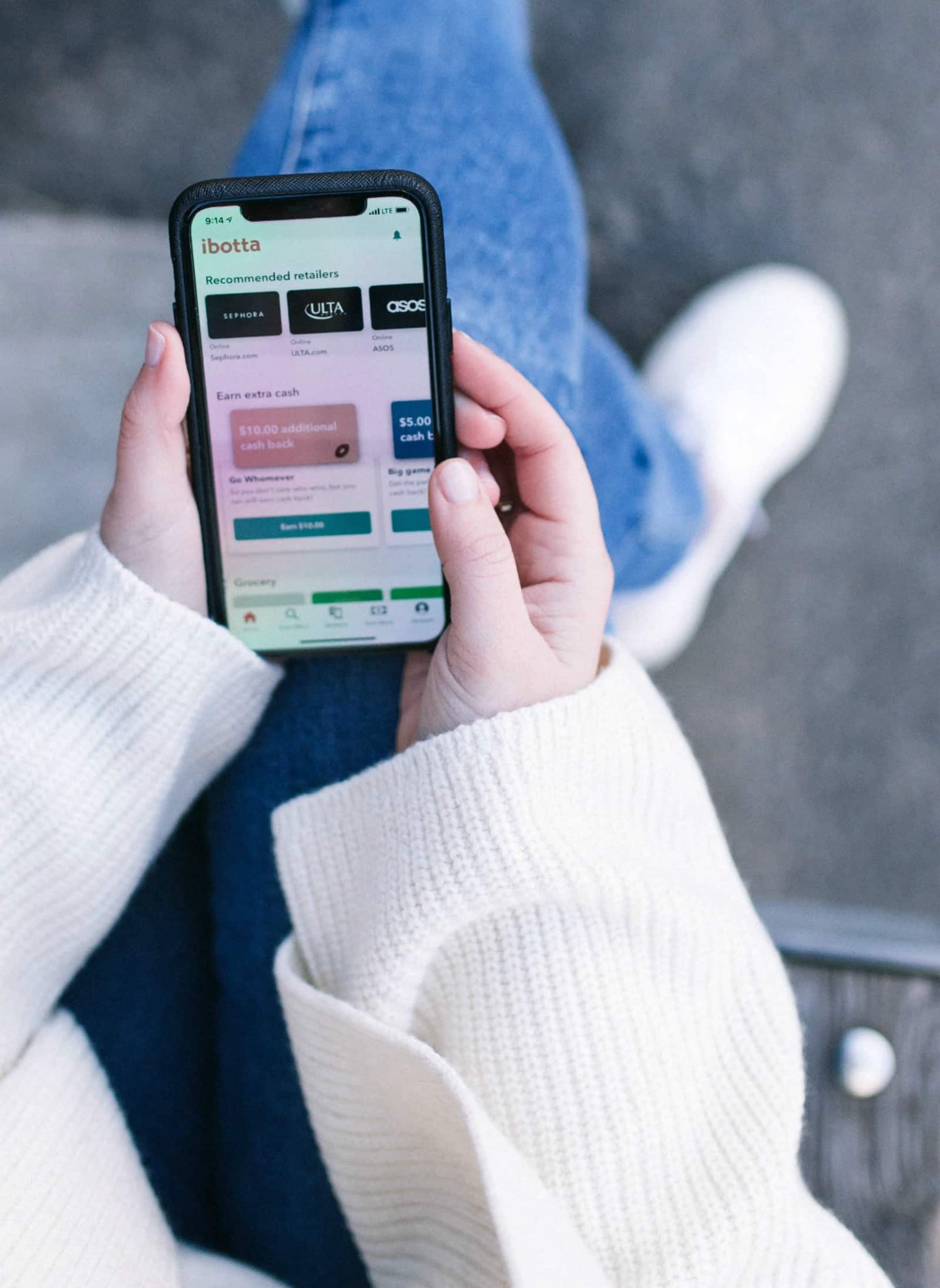

One of my favorite ways to get free money is by using the Ibotta app with their Cash Back feature. Ibotta gives me cash back that I can use for future purchases or put towards savings goals. Not familiar with Ibotta? Ibotta is a free app that rewards you for shopping. When shopping on Ibotta through all their retail partners (everyone from Ulta and Sephora to Amazon and Target), you’ll receive offers and earn cash back on your purchases. You can even get cash back when you go to CVS or the grocery store as the app has offers for things you buy often such as toilet paper or cereal!

Set up a money market account.

Similar to the above “go after free money,” savings accounts with higher interest rates will let your hard earned money accrue more. Have a big savings goal? Consider a money market account or other high-interest bank account. I was given guidance to do this last year and after doing so I couldn’t believe I let my money sit in a savings account earning a pittance of interest every year when it could have been making a lot more in interest. Once you have a decent savings definitely research where that money will be best kept.

Make credit card points work for you.

Many of my Paris trips in the past several years have included free airfare because I booked them on American Express points. I have the Delta x American Express credit card for one of my businesses and I can’t recommend it enough. I cash in the points for Delta flights to Paris. And I have also spent a long time educating myself on how to best take advantage of credit card points. And of course be sure you are enrolled in all frequent flier and hotel loyalty programs.

If you don’t currently have a credit card that offers good points, do your research and then when you want to apply, call and ask for more bonus points than they are currently offering. I did this when I knew I was planning to quit my job and needed a new business credit card for wit & whimsy. I had to buy a new computer so I knew I’d easily hit the threshold of $$$ spent within the first three months. So I called American Express and told them my roommate was being offered more bonus miles after the threshold was met and that I’d like that offer. As soon as I was approved for the Delta x American Express card they honored the 60,000 bonus miles offer my roommate had gotten in a direct mail brochure vs. the 40,000 I had been sent.

Automate Savings.

One of the best things I ever did for myself was set up automatic transfers every month from my checking into my savings. I’m much better having money in places I don’t see or touch often. I make monthly automated contributions to my retirement account and also to my personal savings account. If you are historically not good at savings, this is absolutely one of the best things you can do for yourself. (Also when you use the Ibotta app you can easily transfer what you earn from shopping via the app into a bank account (using PayPal) once a month or once a quarter!)

Max out your annual Roth IRA contribution.

A Roth IRA is a retirement savings account that allows your money to grow tax-free. You fund a Roth with after-tax dollars, meaning you’ve already paid taxes on the money you put into it. In return for no up-front tax break, your money grows and grows tax free. And when you withdraw at retirement, you pay no taxes. Doing the max yearly contribution is something that took me a while to be able to do. But now I reap a tax benefit for doing so each year. I love knowing I have this money set aside for my retirement.

Consider insurance.

Having insurance can seem like a big monthly expense but it can really benefit you in the long run. Have kids? Look at getting life insurance. Have a car? Get car insurance. Set you and your loved ones up for the better by being insured.

Have an HSA.

If you qualify for one, a Health Savings Account, or HSA, is a unique, tax-advantaged account that can be used to pay for current or future healthcare expenses. The money is set aside and can go to things like prescriptions, co-pays and treatments like acupuncture that may not be covered by your regular health insurance plan. It is also great to have in case you have unforeseen medical expenses like a trip to the emergency room or surgery. The money is already set aside and is ready to be used when you need it.

Set up all the alerts your bank and credit card company allow for.

I have alerts set for every time my debit card takes out cash at an ATM, for every time a foreign transaction takes place, for every time that my credit card is charged but isn’t present at the transaction and others. If you don’t have alerts set up you may not know if your credit or debit card is being used without your authorization. Or that you have recurring charges for services you no longer want or need. Alerts is also how I learned I needed to get a travel credit card with no foreign transaction fees. I went to Europe in 2014 and paid fees for every purchase I made on my credit card – yikes!

Set financial goals and become more intentional with your purchases.

I always recommend to people to develop a list of things you want and stick to purchasing from that list. Want more investment pieces in your wardrobe? Or want to take a special vacation this year? Add everything to a list and shop from that list exclusively. This will help you avoid impulse purchases which is the #1 reason people veer off of budgets or accrue credit card debt.

I often tell friends who are trying to justify purchases they really want to – next time they are impulse shopping and about to check out at Zara or the like – to add up the total of the price tags in their arms. Write that number down in your Notes app and walk away from the checkout line. Then transfer that dollar amount from your checking into your savings.

If you were going to spend it on impulse purchases, you can afford to put it into savings and have it start being stored away for something special. Another tactic is to institute a 24-hour rule for any non-essential purchases. Curb your urge for 24 hours. Once the time has passed ask yourself whether the purchase is really worth it. You’ll most likely realize you don’t need it and you can put that money into your savings instead.

Having a financial plan that helps you reach your goals will be one of the most empowering things you can do for yourself. I promise!

Ask for help.

We can learn a lot from those who came before us. Ask family members and friends for any advice they have or things they wish they’d known about money management. Take note from their experiences. Want to get started in investing or understand your retirement accounts better? Find a resource to help you do so. There are services like Betterment but you can also hire a financial advisor to do a consultation. Your bank will also be happy to help you if you make an appointment to go over your finances. Finally, consider hiring an accountant to help with your taxes one season to get advice on things you could be doing better and new strategies you should employ to better set yourself up for success.

Find other ways to make money.

Long before I was self employed, I was keeping up wit & whimsy and making money from it on the side. It allowed me to shop more than I would have otherwise, travel more and save more. It required working on weekends and late into the night many a week night but it was 100% worth it. If you have a hobby or talent that could earn you money on the side, it is a great way to begin saving more money. Take whatever you earn and put it straight into a savings account. Use it to put towards a larger savings goal or to treat yourself from time to time.

Save more with small changes.

When I first became self-employed I majorly tightened my purse strings because I was unsure when I would start getting regular paychecks again. I made most of my meals at home, stopped buying coffee out, ate a lot of leftovers, checked prices religiously to ensure I was buying things on sale whenever possible. I took a lot of other small steps that eventually made a major difference on my bank accounts. It wasn’t about restraining myself or never allowing myself to indulge. But more so getting into different routines and habits that would help me in the long run. If spending too easily is a problem for you, try beginning to use cash more often. This way, you’re more aware of when and how often you’re spending.

. . .

Remember that you are capable of doing anything you put your mind to! Money management is incredibly stressful. But getting smart about it and making it a priority in your life can lead to many fruitful benefits! Do you have any money management tips you swear by?

p.s. the better habits I’m practicing this year and how to clean out your closet.

Thanks to Ibotta for sponsoring this post. All Ibotta offers were valid as of publish date. I appreciate you supporting brands that wit & whimsy partners with! You can see my past partnerships with Ibotta here, here & here.

Love this post! Tracking my spending on Mint and EveryDollar has made me realize how much I spend eating out and going to Target and cut back in those areas. I highly recommend zero based budgeting (where you “tell” every dollar where to go instead of saving what is left over). Next step is to meet with a financial advisor and see if I’m on the right track, and figure out what to open for higher interest savings (money market or ETF probably!). Taking advantage of 401K employer match and compounding interest have made a huge difference for me – saving early and often!

Thank you so much for weighing in! GREAT point about 401K matching. Love hearing your advice!

I love all these tips! I’d also recommend a book I’ve been reading, “I Will Teach You to be Rich.” The name sounds hokey, but it’s filled with easy to understand and easy to follow advice. The author’s teaches you to think of money as a means to create a “rich life” – whatever that means to you. Prioritize spending where it makes you happiest and enjoy those purchases guilt free, but cut back in areas that aren’t important to you.